Intel prospects are shopping for up all its older CPUs to beat tariffs

How are Intel’s prospects weathering tariffs and a attainable recession? By shopping for Intel’s older merchandise, and never its newest chips.

Intel chief monetary officer David Zinsner informed analysts on Thursday that Intel bought extra quantity in its Raptor Lake chips than Lunar Lake, suggesting that prospects most well-liked the higher-performance Raptor Lake chips that debuted in 2023 versus the newest Lunar Lake chip that launched final September.

In the meantime, Zinsner instructed that Intel’s future is extraordinarily unsure, as a result of Trump administration’s various financial coverage. “The very fluid commerce insurance policies within the U.S. and past, in addition to regulatory dangers, have elevated the prospect of an financial slowdown with the chance of a recession rising,” Zinsner mentioned. “This makes it tougher to forecast how we’ll carry out for the quarter and for the 12 months, even because the underlying fundamentals supporting development I mentioned earlier stay intact.”

Zinsner additionally gave an unlimited vary for the corporate’s spending plans of between $8 billion and $11 billion, as a result of Intel doesn’t know what the way forward for the CHIPS Act could be.

Older, cheaper, higher-performance Intel CPUs are the favourite

The shock, nonetheless, was how Intel’s prospects are coping with tariffs — merely shopping for older merchandise as an alternative. Intel executives mentioned that the Intel 7 course of — the muse of the Raptor Lake chips — was constrained, and so was manufacturing of the chip itself. That’s as a result of prospects are snapping up older Intel CPUs that compete with and even beat Intel’s newest components.

Intel didn’t specify whether or not it was desktop PC prospects or laptop computer prospects who most well-liked Intel’s older components.

Intel

Michelle Johnston Holthaus, who returned to her position as head of Intel Merchandise after serving as the corporate’s co-CEO for the interval after former chief govt Pat Gelsinger stepped down, defined that prospects have been preferring “N-1” merchandise, or the brand new code for older components.

“What we’re actually seeing is way better demand from our prospects for N-1 and N-2 merchandise in order that they’ll proceed to ship system value factors that buyers are actually demanding,” Holthaus mentioned. “As we’ve all talked about, the macroeconomic issues and tariffs have all people sort of hedging their bets in what they should have from a list perspective. And Raptor Lake is a good half.

“Meteor Lake and Lunar lake are nice as properly, however include a a lot greater value construction, not just for us, however on the system value factors for our OEMs as properly,” Holthaus added. “And in order you concentrate on an OEM perspective, they’ve additionally, you realize, ridden these value curves down from a Raptor Lake perspective, and it permits them to supply that product at a greater value level. So I actually simply suppose it’s, you realize, macroeconomics, the general economic system, and the way they’re hedging their bets.”

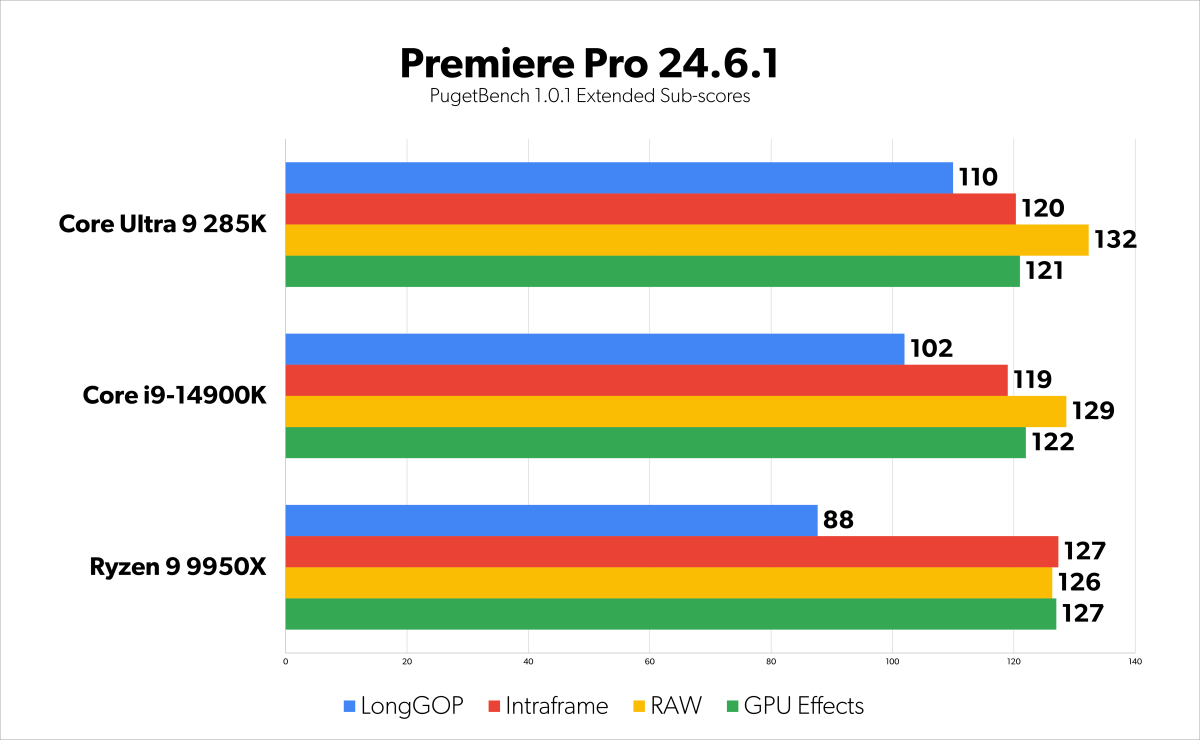

That’s not that shocking. The comparatively anemic efficiency of Intel’s newest Core Extremely 200-series components was matched by an equally anemic reception. As our Arrow Lake desktop evaluation confirmed, Intel’s Fifteenth-generation Arrow Lake desktop components mainly provided the efficiency of Intel’s Raptor Lake era.

Adam Patrick Murray & Will Smith / PCWorld

What does this imply for Panther Lake?

In the meantime, Intel is readying the launch of Panther Lake and its 18A expertise for later this 12 months. Lip-Bu Tan, in his first earnings name as Intel’s chief govt, mentioned that Panther Lake could be accessible earlier than the top of the 12 months, however Zinsner mentioned that the majority of shipments could be in 2026. So will prospects purchase Panther Lake, in the event that they ignored the earlier two chips, Bernstein analyst Stacy Rasgon requested.

“The Panther Lake launch matches precisely what we did on each Meteor Lake and Lunar Lake with reference to timing,” Holthaus mentioned, successfully refuting that the launch could be delayed. “So it’s very aligned with how prospects prefer to take merchandise to market.

Mark Hachman / IDG

“Panther Lake is a good product, each from a efficiency and value perspective for purchasers,” Holthaus added. “So I believe you’ll see a robust uptake of that product, proper? We nonetheless see very robust industrial demand for AI PCs as [customers are] deploying their fleets, as they’re doing their upgrades, they wish to future-proof their merchandise and have that AI functionality. So I don’t suppose you’re going to see that change in industrial. And when you have a look at our conventional ramps for all these merchandise, we are inclined to go quicker in industrial first, after which shoppers come on board. And so we’ll should steadiness, the place is the economic system on the finish of the 12 months, however I really feel very bullish in regards to the Panther Lake product and our buyer suggestions.”

Holthaus mentioned that Intel’s objective is to convey 70 p.c of all of the silicon utilized in Panther Lake in-house, or manufactured at Intel’s fabs. With Nova Lake, Intel 2026 processor structure, Intel will attempt to transfer much more onto Intel foundries. “Once you have a look at the combination of Nova Lake, we’ll construct extra wafers on Intel course of than we’re on Panther Lake,” Holthaus mentioned.

Basically, Intel’s priorities are to construct belief in Intel’s personal manufacturing applied sciences, then lengthen that belief to profitable extra prospects for Intel’s foundry enterprise, Tan mentioned.

When requested how lengthy this may all take, Tan demurred. “There is no such thing as a fast repair,” he mentioned.

In a observe shared publicly, Tan mentioned that Intel will “take away organizational complexity” by eradicating layers of administration, and requiring workers to work on the workplace 4 days every week or extra.

Intel reported a GAAP lack of $800 million on income that was flat with a 12 months in the past, at $12.7 billion. Intel’s Consumer Computing Group recorded $7.6 billion in income, down 8 p.c from a 12 months in the past.