Intel’s robust resolution boosted AMD to document highs

Abstract created by Sensible Solutions AI

In abstract:

- PCWorld studies that Intel’s provide constraints and strategic deal with higher-margin server processors in This fall 2025 created a chance for AMD to seize document market share.

- AMD benefited considerably from Intel’s capability reallocation, gaining floor in each cell and desktop processors because the x86 market shifted from 80-20 to 70-30 Intel-AMD ratio.

- Whereas each corporations noticed server CPU development, Intel’s cell consumer shipments suffered most, permitting AMD to realize unprecedented client market penetration.

Shipments of x86 processors dropped from the third to the fourth quarter of 2025, as Intel’s provide constraints reined in PC processor shipments and helped AMD, particularly within the cell market.

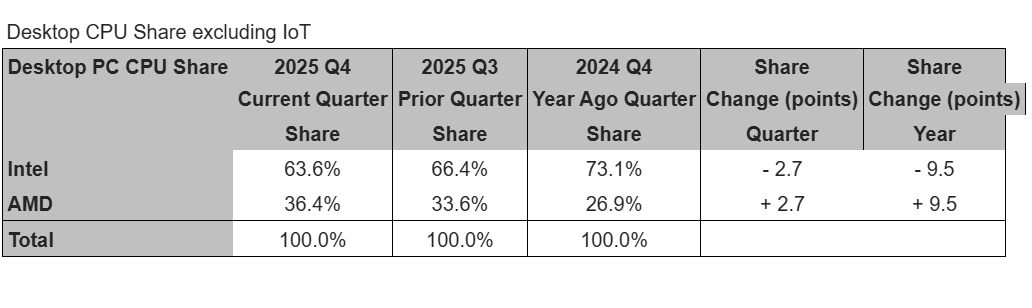

AMD itself launched among the cargo estimates from Mercury Analysis on Wednesday, however the analysis agency added extra particulars on Thursday, together with Intel’s market share. It additionally confirmed that AMD has now hit document share in each cell and desktop processors.

Usually, the fourth quarter of the yr represents the very best gross sales, as Black Friday and the winter holidays contribute to customers snapping up bargains on desktop CPUs and desktop PCs and laptops. On this case, nevertheless, Intel made the aware option to restrict client CPU gross sales and favor servers, after poor course of yields and shortages compelled a tricky resolution to push higher-margin server elements. The slowdown additionally included fewer gross sales of AMD SOCs into consoles, that are heading into their seventh straight yr with no refresh, although that might are available in 2027, AMD chief govt Lisa Su mentioned.

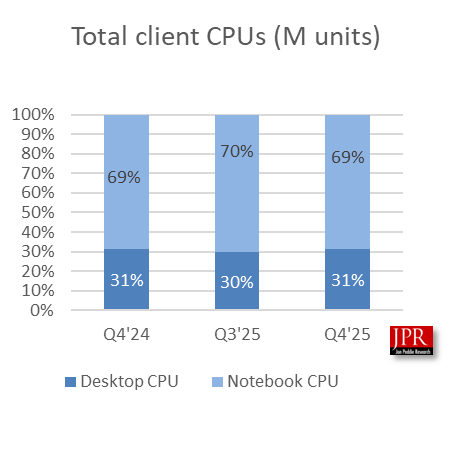

Usually, Intel had held on to a 80-20 ratio within the PCU house, however that’s repeatedly narrowed as AMD’s share has elevated. Now, it’s extra like 70-30.

Mercury Analysis

Excluding these SOCs, “AMD’s shipments considerably outgrew Intel’s, each sequentially and on yr, leading to sturdy share will increase by each measures,” Mercury Analysis president Dean McCarron wrote in a word to reporters. “AMD noticed far stronger than median seasonal development development throughout all segments within the quarter (besides SoC gaming merchandise not included on this calculation.) In distinction Intel’s desktop and cell shipments had been weaker than seasonal attributable to provide constraints, and whereas Intel’s server CPU development barely offset the downturn in consumer it was not sufficient to influence general share change.”

In desktops, AMD grew throughout all of its product traces, and never simply in high-end processors like in earlier quarters. Development favored mid-range merchandise as a substitute. Mix that with Intel’s resolution to de-prioritize desktop merchandise, and AMD once more hit a document excessive in desktop CPU shipments.

Mercury Analysis

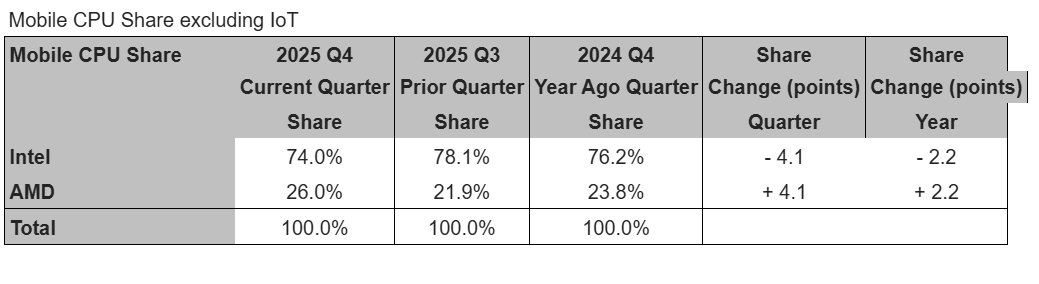

However AMD additionally hit a document excessive in its share of cell processors.

“Intel’s capability reallocation hit the corporate’s cell consumer CPU shipments the toughest, leading to Intel experiencing important sequential and on-year declines in shipments, far under seasonal norms in what is usually an up quarter,” McCarron wrote. “In distinction, cell consumer CPUs was AMD’s strongest section within the quarter. This resulted in a big enhance in AMD’s share of the cell CPU market, which set a brand new document excessive within the quarter.”

Mercury Analysis

The wild card, as all the time, stays Arm.

“There’s a bigger than typical uncertainty in our ARM estimates this quarter as sturdy PC sell-out made figuring out CPU sell-in harder than common,” McCarron wrote. “Nonetheless, attributable to Apple’s declines within the section we’re moderately certain general ARM consumer shipments declined within the quarter, however gained’t be shocked if we have to revise the figures within the subsequent version because of the uncertainty.”

Mercury’s McCarron estimated that Arm share within the PC house, together with Apple Macs and Arm Chromebooks, must be about 13.3 p.c. That’s barely lower than the 13.7 p.c that section noticed a yr in the past, he mentioned.

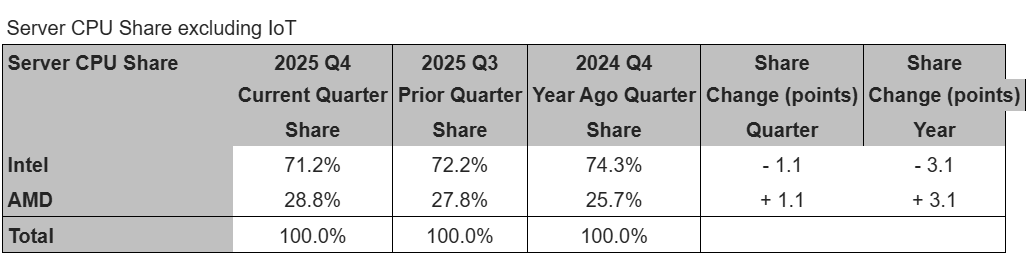

Intel’s renewed focus within the server market, nevertheless, and AMD’s emphasis there additionally introduced with it important development in server shipments. Intel’s shipments right here grew by double the seasonal common, McCarron wrote, with AMD tripling its common right here as effectively.

Mercury Analysis

Jon Peddie Analysis, a competing group, reported barely totally different numbers; it discovered that the worldwide consumer CPU market grew 2.7 p.c sequentially, whereas server CPU shipments elevated 14.1 p.c, yr over yr.

“We predict the PC CPUs’ development was in keeping with seasonal shopping for conduct, albeit a bit low,” Jon Peddie, president of JPR, mentioned in a word. “The affect of the up-again, down-again tariffs, and Microsoft’s withdrawal from help of the 2016 Home windows 10, additionally had an impact. We anticipate Q1’26 to be down attributable to reminiscence constraints and better course of.”

Jon Peddie Analysis