The hidden value of cashback: How buying extensions observe you—and the way to restrict it

Abstract created by Sensible Solutions AI

In abstract:

- PCWorld explains how cashback extensions like Rakuten extensively observe looking historical past, buy particulars, and system data, usually sharing this information with third events regardless of opt-out choices.

- This complete information assortment poses important privateness dangers, as leaked buying data might allow focused scams, phishing assaults, or personalised extortion makes an attempt.

- Financial institution cashback affords present safer alternate options utilizing present transaction information, whereas protecting measures embody utilizing separate browsers and selecting companies with clear privateness insurance policies. Detailed directions are supplied under.

I’ve acquaintances who speak excitedly about cashback websites for buying—and I get the attraction. Why not get a refund in case you’re already going to be shopping for these issues anyway? However I’m the one who replies, “Have you ever seemed into what they do along with your information?”

(I’m very enjoyable to speak with at events.)

Right here’s the factor: Cashback websites might be helpful, as long as you’re good about how you employ them. What web sites find out about you can also make life more durable within the improper circumstances.

What’s a cashback web site?

Cashback web sites work like this: You put in an extension in your browser (or an app in your cellphone), then begin buying. As you go to on-line shops, notifications will seem when a proposal is offered—both a share (usually capped at a specific amount) or a set greenback reward. Main cashback websites embody Rakuten (previously Ebates), Swagbucks, and TopCashBack.

Throughout peak buying durations like Black Friday and Cyber Monday, some incentives can leap up significantly. For instance, throughout Cyber Monday, cashback reached as excessive as 15 p.c for some retailers. Spend even $50 to $100, and that begins so as to add up. (On the very least, it covers gross sales tax and a bit further for most individuals.)

Comparable (however nonetheless totally different) are cashback affords by banks, usually tied to a bank card. You activate the provide by your financial institution’s web site or app first. Then when a cost to your bank card matches an lively provide, you mechanically get a partial refund utilized, in line with the phrases (e.g., 2 p.c again, as much as $5). Typically these might be fairly sizable—like $100 off a $500 or extra buy at Dell. The affords cycle usually, with set expiration dates. You additionally should activate them first earlier than they apply—they received’t depend retroactively.

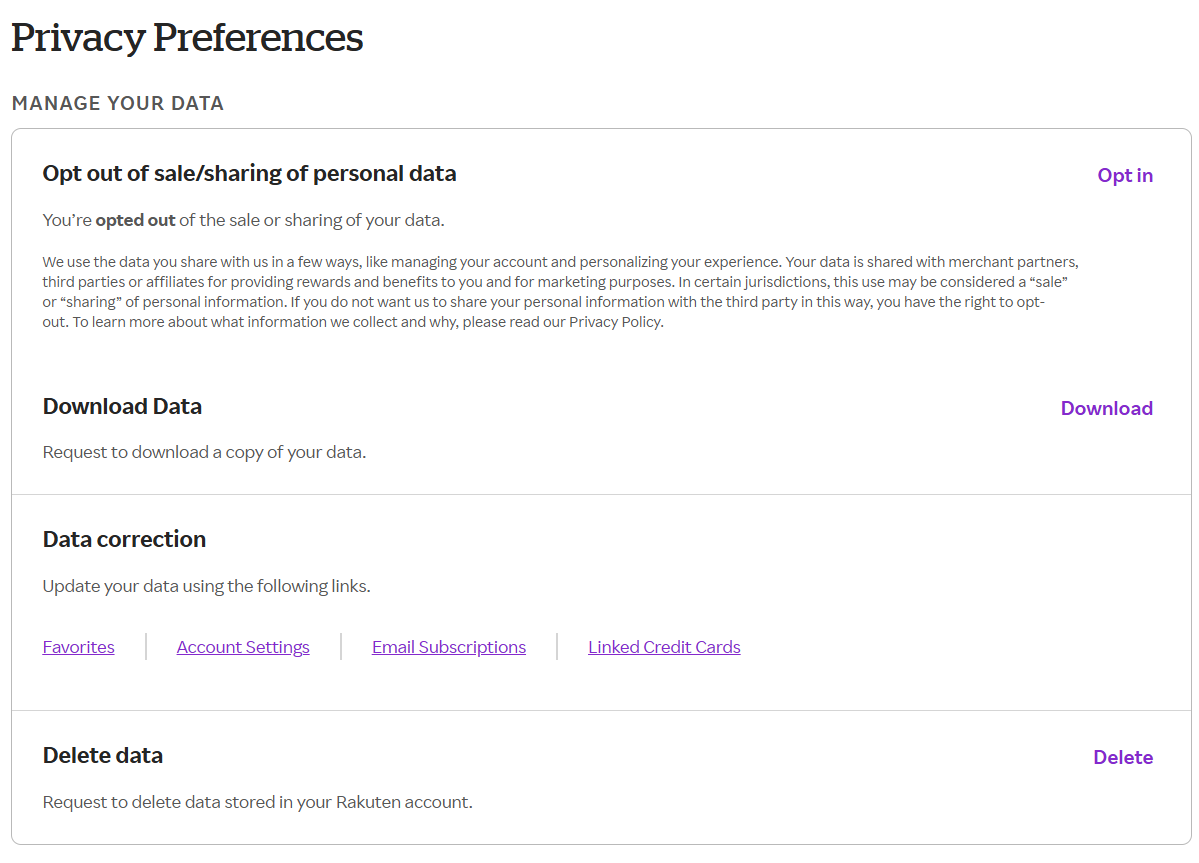

Rakuten

The principle distinction between cashback web site and cashback affords is {that a} cashback web site screens all your on-line buying exercise. Take a look at among the data collected by Rakuten, which is outlined in its privateness coverage:

“…information of merchandise, product varieties, retailers, service provider varieties, items or companies bought, obtained, or thought of by you, together with merchandise, retailers and coupons you looked for, considered or clicked, gadgets added to cart and deserted, buying journeys initiated, service provider websites visited from our Providers, transaction historical past associated to our Providers, buy affirmation information…”

The remainder of Rakuten’s coverage defines a number of different classes of captured information, together with the URLs of pages you go to, timestamps of whenever you’re looking, and the final web page that you simply have been on earlier than you arrived at Rakuten’s web site. Rakuten additionally clearly says it makes assumptions about your seemingly preferences, pursuits, and habits, as permitted by regulation.

Why? Rakuten says it received’t promote your information to 3rd events, however except you choose out, it will possibly (and can) share your information with third-parties. It additionally has a vested curiosity in understanding the way you tick, in order that it will possibly higher entice you to buy….even whenever you maybe don’t intend to.

Financial institution of America

As for cashback affords, they’re extra restricted within the data your financial institution finally ends up with. The financial institution sees the transaction, after which mechanically applies your reward. However that’s not further information the corporate is receiving—it already would know the place and whenever you’re buying based mostly on the fees. And your financial institution is already profiling you, partially to assist fight fraudulent prices and exercise if it occurs to your account.

Your financial institution can (and can) share its information with third-party associates each to supply service and to permit these exterior companies to market to you. You may nonetheless decide out of such information sharing (which I like to recommend).

So what’s the issue with cashback websites having my information?

As an train, I began a Rakuten account, did a bit navigating, and made a few small purchases. Then I made a knowledge request to see what kind of data they captured from me.

It’s nothing significantly surprising, in case you’re already conversant in Rakuten’s privateness coverage. I positively noticed information on the websites that I visited and the instances, the merchandise I purchased, data on the system and browser I used, and the like.

Rakuten

There’s a whole lot of information, most of which appears innocent. However let’s not neglect: We’re now within the period of internet sites simply hacked, and private information leaked. That data stays on the web eternally. And buying information incorporates a whole lot of seemingly mundane however nonetheless private details about you—and now a cashback web site is amassing all of this in a single, handy place.

That data might be used to craft personalised assaults—assume scams by way of phishing and even extortion, if a nasty actor thinks you may be inclined to sure sorts of scams or might be embarrassed by public disclosure of your buying habits.

Ought to I cease utilizing cashback websites and cashback affords?

The quick reply is not any, although some people could discover their privateness is price forgoing a bit cashback. Nonetheless, I like to recommend being savvy about how you employ them.

My private take is that I can’t predict the long run, so the much less private information that would leak, the higher. Twenty years in the past, I didn’t think about we might join on-line as quick as we do now, a lot much less extrapolate tiny particulars about strangers by just a bit bit of knowledge. (The teams of oldsters who can establish a location simply from a handful of clues in a photograph are each wildly spectacular and positively unnerving.)

So I might:

- Select websites that clearly state what data they acquire and the way they use it. Keep away from ones that promote your information to 3rd events.

- Create and use passkeys for as many buying websites as doable. (Actually, all websites that provide them.) These can’t be phished, so if there ever is a leak of your buying information and also you begin getting hit by phishing emails, you’ve got a a lot decrease probability of caught off-guard by a nasty electronic mail or message.

- Restrict your cashback buying exercise to a separate browser—and solely use that browser whenever you’re able to make the acquisition. This minimizes the knowledge {that a} cashback web site can acquire about your looking habits.

(Talking of nice various browsers—once I poking round at cashback websites, I used Vivaldi. It’s well-regarded by my colleagues Mark Hachman and Michael Crider and I now can say I get why they prefer it.)

Occasions are powerful economically, and the forecasts indicate it might be more durable this coming yr. (I hope not, however…) So cashback is smart. Simply guarantee it is smart on your long-term on-line security, too.